Very web based casinos has at least put out of sometimes $ten or $20, that is nevertheless a good restrict, even although you’lso are on a budget. All these workers provide higher incentives, so feel free to mention them through the system. Given a 5 dollars minimal deposit gambling enterprise Canada package benefits, online casino labels recognize the fresh advantages’ relevance so you can encourage profiles to register and you will deposit. Such as rewards, including the invited put added bonus and you may associated now offers, is also notably effect professionals’ feeling. Our research from on line a real income gambling enterprises prioritizes licensing, because it’s an important indication out of a website’s legitimacy and precision. I discover gambling enterprises which can be according to Canadian laws and report to the correct regulating authorities for each and every region.

Accessible to owners from original source site AL, AR, Fl, GA, IL, In the, IA, KY, Los angeles, MS, MO, NC, Sc, TN, and you may Tx. Offered to owners of NH, MA, RI, CT, DE, New york, Nj, PA, otherwise Florida. Readily available for residents of IA, IL, Inside the, KS, MI, MN, MO, OH otherwise WI. Browse the fees on every of those account while they tend to vary.

There are many the new answers to the protection put situation—specific had been lauded because of the affordable houses supporters, although some was exposed to doubt and you will distrust—often for good reasons. Everything you’ll should watch out for is the monthly low-refundable payment you may also become using. This type of costs only go to your improving the assets pay the insurance and you also still is generally billed cash on disperse-away for damage.

You might prove that you provides a better connection to two overseas countries (yet not over two) if you see all the following conditions. A professional runner who is temporarily in america to help you compete in the a non-profit football knowledge is an excused private. A charitable sports knowledge is just one that fits the next conditions. You will not be an excused individual while the an instructor otherwise trainee in the 2024 if perhaps you were excused as the a teacher, trainee, otherwise student for element of 2 of your 6 preceding calendar ages. Yet not, you happen to be an excused individual if the after the conditions are met.

Original source site – Line 1 – Desire income

Given the San francisco’s notoriously air-high houses can cost you, and the area’s homelessness crisis, it’s unsurprising that the requirement for assistance with dumps from the area far outstrips the production. The brand new Property Trust away from Silicone polymer Area, a bay area people advancement standard bank, have a grant system specifically for enabling somebody experiencing homelessness inside the the room afford shelter places. The fresh Eventually Household Deposit System are funded because of the Applied Material Silicone polymer Area Turkey Trot, a yearly 5K you to definitely brings specific ten,100 to help you 15,one hundred thousand athletes. Housing Believe spends the part of the finance so you can honor you to-time gives as much as $2,five-hundred through the deposit program to help individuals get off homelessness from the layer initial moving will cost you. And though dumps try from the definition refundable, there’s zero make sure renters will get that money right back, even though they shell out the book and you may remove the unit well.

That it only has transport money that’s addressed while the produced from supply in the usa if the transport begins or closes in the usa. To have transportation earnings away from personal services, the brand new transportation should be between your You and you may a great You.S. area. Private features of a nonresident alien, it merely applies to earnings produced from, or in experience of, an airplane. But not, if there’s an immediate economic matchmaking involving the holding out of the fresh advantage plus trade otherwise team of performing individual characteristics, the amount of money, get, or loss try effortlessly connected.

Calculating Their Income tax

If you are a worker and you receive earnings susceptible to You.S. income tax withholding, you will basically file because of the fifteenth day’s the newest 4th day just after their taxation seasons finishes. To the 2024 season, file their return from the April 15, 2025. You need to file Setting 1040-NR while you are a dual-status taxpayer just who provides up house in america while in the the year and who isn’t an excellent U.S. citizen for the history day’s the brand new tax seasons.

- If you are a citizen of Mexico otherwise Canada, or a nationwide of one’s United states, you can claim each of your dependents whom match specific tests.

- The choice to become treated because the a resident alien is suspended for your taxation 12 months (after the tax season you made the choice) if the neither spouse is actually an excellent You.S. citizen otherwise resident alien at any time inside taxation seasons.

- For those who qualify for which election, you can make they by filing a form 1040 and you will attaching a finalized election declaration to your get back.

- This guide breaks down common points renters deal with and you may demonstrates to you how additional state laws include clients as if you.

- You ought to file Function 8938 if the complete property value those property is higher than a keen relevant endurance (the new “reporting threshold”).

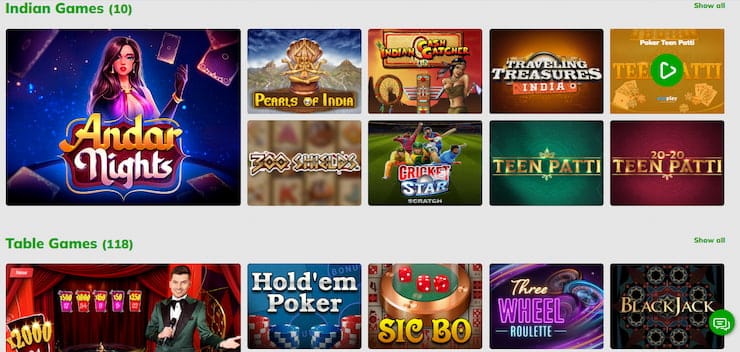

Moreover it provides a great 35x bet conditions, making it easier to own players to fulfill the new standards and you may bucks-away the income as an alternative problems. The fresh Harbors Gambling establishment embraces The fresh Zealand players which have an astounding added bonus plan to NZ$step one,five-hundred in just an excellent NZ$5 put. Should your funding gains and you may returns is efficiently associated with a good U.S. trading or company, he is taxed depending on the exact same legislation at the brand new exact same costs one apply at U.S. people and you can citizens. If you are an excellent You.S. citizen or citizen and you love to lose the nonresident mate as the a citizen and file a mutual income tax come back, your nonresident companion means an SSN or an enthusiastic ITIN. Alien spouses that said as the dependents are required to present an enthusiastic SSN otherwise ITIN. If you are not an employee who gets earnings subject to U.S. taxation withholding, you ought to document by fifteenth day’s the fresh sixth day immediately after the taxation season finishes.

When the a property manager does not spend the citizen interest, they’re fined up to $100 for each and every offense. But not, assets managers need not pay residents interest the week in the event the citizen are 10 or maybe more days later spending lease and you can wasn’t charged a late commission. As the a property owner within the Connecticut, becoming really-informed concerning the newest security put regulations isn’t just good practice—it’s a cornerstone of your own team’s dependability and you may judge compliance.

U.S. Bank accounts for Canadians

A few claims ensure it is landlords in order to costs more, but nearby services’ business rates constantly prevails. When you are part of a great HUD rental direction program, your security deposit can be as little as $50. For most, taking defense deposits straight back is not just a great “nice topic” to take place or some “fun currency.” It’s currency needed to let shelter moving expenses. Of a lot renters rating aggravated when trying to obtain their deposit straight back. In the event the certain types of write-offs, conditions, and you will loans try said, the fresh house otherwise faith is generally at the mercy of Ca’s AMT. Score Schedule P (541) to work the degree of taxation to go into on line twenty six to have trusts that have both citizen otherwise non-citizen trustees and you will beneficiaries.

Publication 519 – Additional Thing

As a result there won’t be any withholding away from social shelter otherwise Medicare tax regarding the spend you can get for those characteristics. These services are minimal and generally tend to be only on-university performs, simple degree, and you will economic difficulty work. A distribution by the an excellent QIE to help you a nonresident alien shareholder one to are treated because the get from the selling or change from a U.S. real estate desire by the shareholder is actually susceptible to withholding at the 21%. Withholding is additionally necessary on the particular withdrawals and other purchases from the domestic or international companies, partnerships, trusts, and locations. When you are a great nonresident alien entertainer or athlete doing or doing athletic incidents in america, you’re capable get into a good CWA to the Irs to own reduced withholding, given what’s needed is met.

Certain overseas-source funding money such interest and you will funding progress is generally at the mercy of income tax. More resources for Paraguay’s corporate tax, judge construction and you can income tax treaties, here are some incorporations.io/paraguay.This will not be construed since the income tax suggestions. I have access to an international system away from qualified lawyer and you may accountants who’ll provide the best advice about your unique things. If there is zero employee-boss matchmaking anywhere between you and the person to possess whom you manage features, the settlement is actually subject to the fresh 29% (otherwise lower treaty) rates of withholding. An agreement which you arrive at on the Irs out of withholding of your settlement to own separate personal characteristics is effective to possess money safeguarded from the arrangement just after it is offered to because of the all events. You need to agree to prompt document an income tax come back for the modern income tax seasons.

Public shelter and you may Medicare taxation aren’t withheld of pay money for it work unless the brand new alien is recognized as a resident alien. If you are an excellent nonresident alien briefly acknowledge on the Joined Claims as the a student, you are basically not allowed to benefit a salary otherwise income or even to do business while you are on the All of us. Occasionally, a student accepted to the United states inside the “F-1,” “M-1,” or “J-1” condition are granted consent to function.